August 2022 Housing Market Overview

Greater Louisville Home Price Growth Continues Despite Increasing Supply

Home sales in Greater Louisville declined for the eighth consecutive month in August while prices continued to increase, according to the Greater Louisville Association of REALTORS® (GLAR).

Total existing home sales, including single-family homes, condominiums, and townhomes, decreased 10.4% from 1811 in August 2021 to 1623 in August 2022. Closed single-family home sales totaled 1,418 in August, an 11.3% decrease compared to August 2021, while sales of condominiums dropped 5.2% to 182.

Record demand combined with low supply continues to fuel price growth. The median home sale price in August was $264,650, up 12.6% from $235,000 in August 2021. The average home sale price was $309,000, up 12.4% from $274,986 in August 2021.

“As the Louisville market continues to adjust, demand for housing continues to drive price growth,” said GLAR President Paula Barmore. “While rising interest rates are impacting sales to some degree and inventory is rising, there is still insufficient supply.”

Total housing inventory increased 12.4% to 2,413 at the end of August 2022 from 2,147 in August 2021.

Months of supply in the Greater Louisville market remained low in August but continued to increase. In August, there were 1.6 months of supply, up 23.1% from August 2021 and 6.6 % compared to the previous month. Typically, a balanced real estate market offers between six and nine months of supply. Nationally, there was a 3.2-month supply of housing inventory, according to the National Association of REALTORS® (NAR).

Homes continue to sell rapidly and almost at listing price, reflecting strong demand. The average days on the market were 22 days in August, a 15.8% increase compared to a year earlier and 10% compared to the previous month. The average percentage of list price in August was 98.8%, a negligible 1.3% decrease compared to August 2021.

According to Freddie Mac, the 30-year fixed-rate mortgage was 5.22% in August down from 5.41% in July.

NAR Chief Economist Lawrence Yun noted the housing market is most sensitive to the immediate impact from changes to the Federal Reserve’s interest rate policy and highlighted how these changes are also impacting housing supply.

“Inventory will remain tight in the coming months and even for the next couple of years,” Yun said. “Some homeowners are unwilling to trade up or trade down after locking in historically-low mortgage rates in recent years, increasing the need for more new-home construction to boost supply.”

Note: The method of collection for GLAR statistical information has changed. Some information may vary slightly compared to earlier reporting periods.

August Local Housing Statistical Reports by County:

Breckinridge-County

Bullitt-County

Grayson-County

Hardin-County

Henry-County

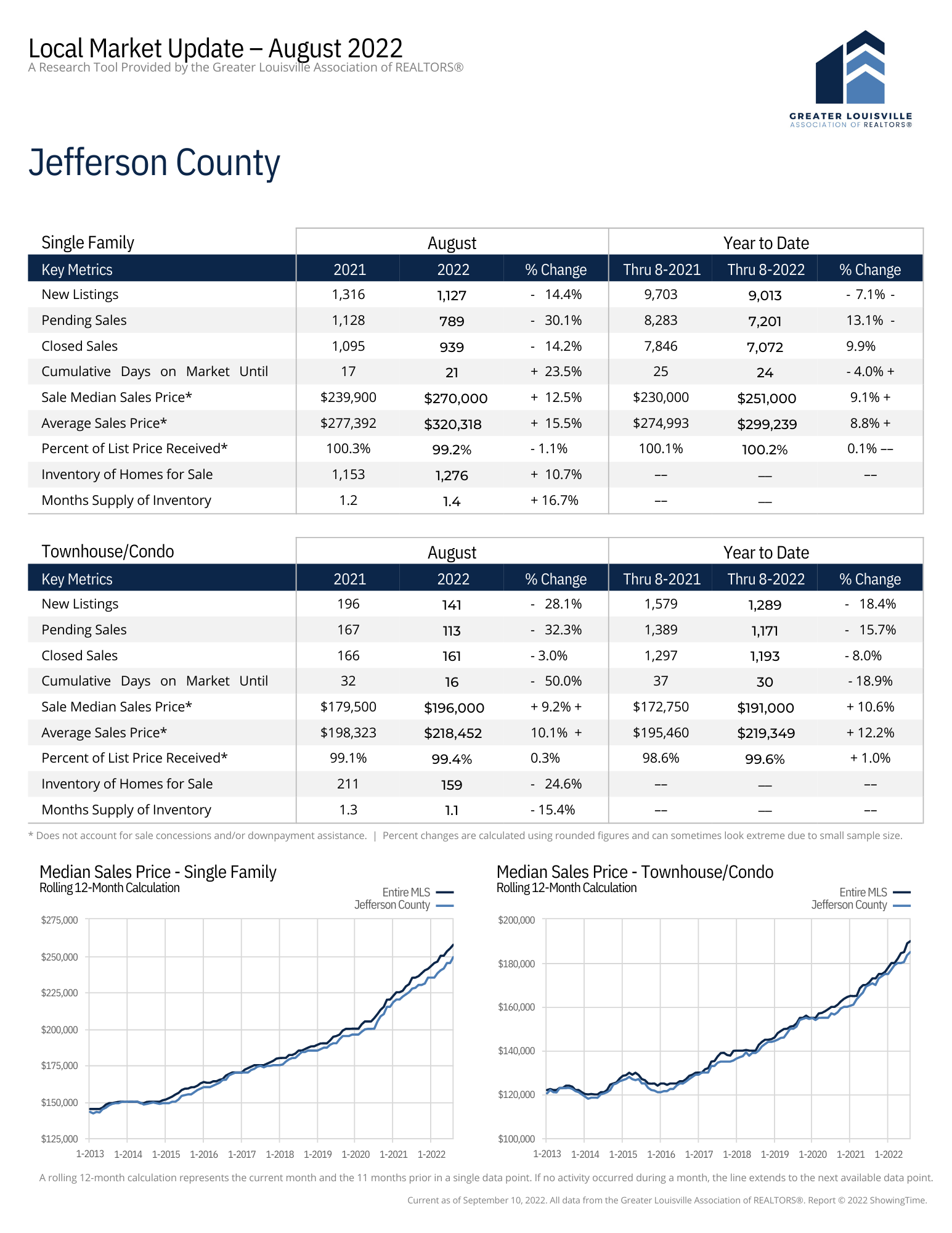

Jefferson-County

Meade-County

Nelson-County

Oldham-County

Shelby-County

Spencer-County

Leave a Reply