March 2022 Real Estate Market Update – Greater Louisville

Despite Rising Interest Rates Greater Louisville Home Prices Increase Again Due to High Demand and Limited Supply

Louisville – Following a record-breaking sales year in 2021, home sales in Greater Louisville declined for the sixth consecutive month due to persisting low supply and rising interest rates, according to the Greater Louisville Association of Realtors (GLAR).

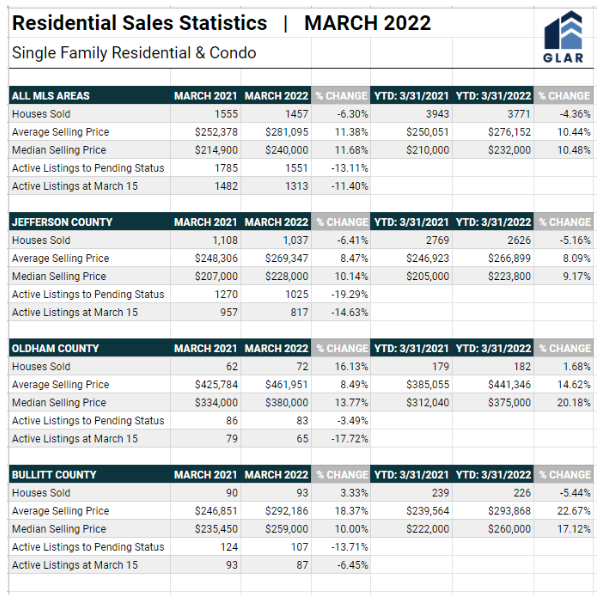

Total existing home sales, including single-family homes, condominiums, and townhomes, decreased 6.30% from 1555 in March 2021 to 1457 in March 2022.

Record low inventory continues to drive home price growth. The median home sale price in March was $240,000, up 11.68% from March 2021 ($214,900). The average home sale price was $281,095, up 11.68% from $252,378 in March 2021.

The Greater Louisville market again had under one months (0.79) of supply in March. A balanced real estate market offers between three and six months of supply.

According to Freddie Mac, the 30-year fixed mortgage rate rose to 5% on April 14 from 4.72 the previous week.

“Unlike more expensive markets in the country, Louisville offers more moderately priced homes for all types of buyers,” said GLAR President Paula Barmore. “Therefore, surging interest rates don’t impact local buyers as much as they would those in other U.S. metros.”

But NAR Chief Economist Lawrence Yun notes that rising rates and escalating prices are affecting affordability and preventing many consumers in other markets from making a purchase.

“The sharp jump in mortgage rates and increasing inflation is taking a heavy toll on consumers’ savings,” he said. “However, I expect the pace of price appreciation to slow as demand cools and as supply improves somewhat due to more home construction.”

CLICK HERE FOR MORE STATS INFORMATION

Leave a Reply